Healthcare billing never stands still. Rules change. Payers tighten controls. Compliance checks grow sharper. In the middle of all this, two identifiers continue to confuse providers more than they should. The National Provider Identifier (NPI) and the Tax Identification Number (Tax ID or TIN).

They look simple on paper. Yet in medical billing, mixing them up can delay payments, trigger rejections, or even raise compliance red flags. Over the past year, payers have increased data-matching edits, making NPI and Tax ID accuracy more critical than ever.

This blog explains how NPIs and Tax IDs differ, how they work together, and why mistakes cost money.

Why Understanding the Difference in NPI vs Tax ID is Essential

In 2026, CMS and commercial payers expanded automated claim validation. Claims are now cross-checked instantly against enrollment files, IRS records, and credentialing databases.

As a result, even minor mismatches between NPI and Tax ID are causing:

- Delayed reimbursements

- Claims stuck in pending status

- Unexpected rejections after submission

- Re-enrollment requests from payers

According to industry reports, identity-related claim rejections increased by more than 18% year over year, with NPI and TIN mismatches leading the list.

That is why understanding this difference is no longer optional.

What Is an NPI and Why Does It Exist?

The National Provider Identifier is a unique 10-digit number assigned to healthcare providers in the United States. It was created under HIPAA to standardize provider identification across the healthcare system.

Before NPIs, providers used different numbers for different payers. That confused healthcare providers. NPIs simplified identification by assigning each provider a single national identifier.

An NPI does not change. It does not expire. It follows the provider across states, specialties, and payer contracts.

There are two types of NPIs:

- Type 1 NPIs are for individual providers such as physicians, nurse practitioners, and therapists

- Type 2 NPIs are for organizations such as group practices, hospitals, and clinics

Each serves a different role in billing and enrollment.

What a Tax ID Is and Why Payers Care

The IRS issues a Taxpayer Identification Number (TIN). It identifies a business entity for tax purposes. In healthcare, it determines who gets paid.

A Tax ID may be:

- An Employer Identification Number (EIN)

- A Social Security Number (SSN) for sole proprietors

Unlike NPIs, Tax IDs are not healthcare-specific. They exist outside billing. Yet payers rely on them to route payments correctly and report income accurately.

If the NPI identifies who provided the service, the Tax ID identifies who receives the money.

That distinction matters more than many providers realize.

NPI vs Tax ID: The Key Differences

Here is the simplest way to understand it.

- The NPI identifies the provider.

- The Tax ID identifies the payee.

They serve different purposes. They answer various questions. But they must align perfectly in payer systems.

When they do not, claims fail.

Here is the cleanest way to think about it.

The NPI identifies the clinical identity.

The Tax ID identifies the financial identity.

One says who treated the patient. The other says who receives the money.

They work together, but they are not interchangeable.

Why Both Are Required on Claims

Every clean healthcare claim connects three things:

- The rendering provider’s NPI

- The billing provider or organization’s NPI

- The Tax ID is linked to payment

Payers validate all three against enrollment and credentialing records.

If the NPI is correct but the Tax ID does not match enrollment, the claim stalls.

If the Tax ID is correct but the NPI is not enrolled under it, the claim fails.

This is why providers often hear, “Your NPI is valid, but the claim was still denied.”

The issue is rarely the NPI alone. It is the relationship between the NPI and the Tax ID.

| Example of Scenarios: In a solo practice, the difference may seem invisible. The same provider renders the service and receives payment. Still, the roles remain separate.The provider uses their individual NPI to identify themselves clinically. The Tax ID determines how income is reported to the IRS.In a group practice, the distinction becomes more obvious.A physician renders care using their Type 1 NPI. The group bills under its Type 2 NPI. Payment flows to the group’s Tax ID.If any of these elements do not align in payer systems, payment delays begin.In hospitals and large systems, complexity increases further. Multiple NPIs operate under multiple Tax IDs. Without strong controls, mismatches are common. |

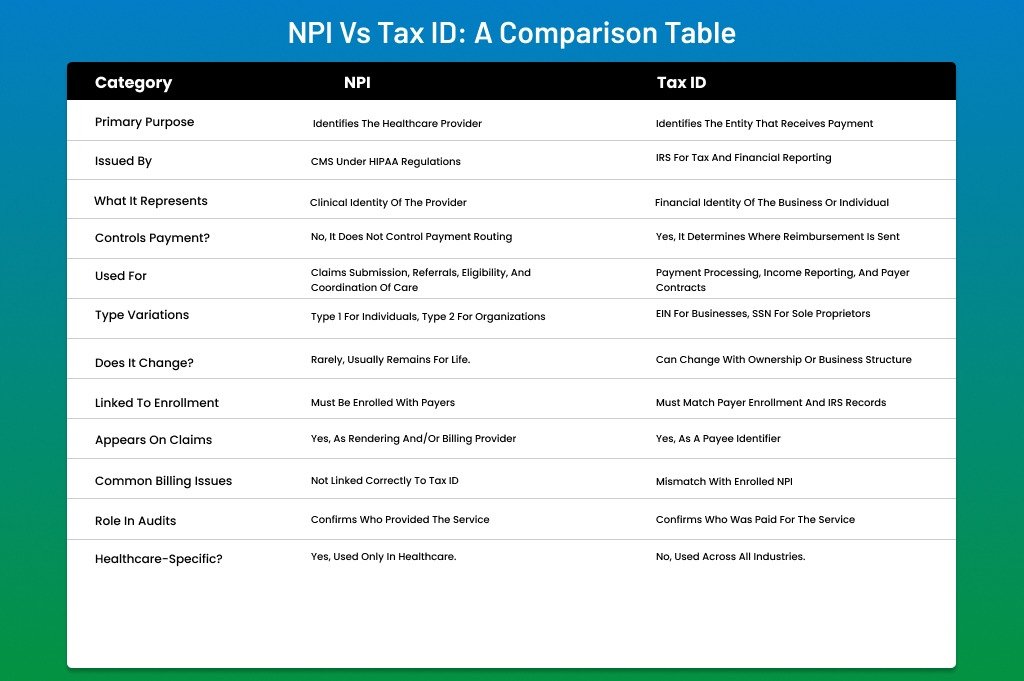

NPI vs Tax ID: A Comparison Table

Understanding the difference between NPI and Tax ID becomes much easier when you see them side by side. While both appear on claims and enrollment records, they serve very different purposes in medical billing and reimbursement.

This table clearly breaks down those differences.

| Category | NPI (National Provider Identifier) | Tax ID (TIN / EIN / SSN) |

| Primary Purpose | Identifies the healthcare provider | Identifies the entity that receives payment |

| Issued By | CMS under HIPAA regulations | IRS for tax and financial reporting |

| What It Represents | Clinical identity of the provider | Financial identity of the business or individual |

| Controls Payment? | No, it does not control payment routing | Yes, it determines where reimbursement is sent |

| Used For | Claims submission, referrals, eligibility, and coordination of care | Payment processing, income reporting, and payer contracts |

| Type Variations | Type 1 for individuals, Type 2 for organizations | EIN for businesses, SSN for sole proprietors |

| Does It Change? | Rarely, usually remains for life. | Can change with ownership or business structure |

| Linked to Enrollment | Must be enrolled with payers | Must match payer enrollment and IRS records |

| Appears on Claims | Yes, as rendering and/or billing provider | Yes, as a payee identifier |

| Common Billing Issues | Not linked correctly to Tax ID | Mismatch with enrolled NPI |

| Role in Audits | Confirms who provided the service | Confirms who was paid for the service |

| Healthcare-Specific? | Yes, used only in healthcare. | No, used across all industries. |

Why Confusion Between NPI and Tax ID Causes Billing Problems

Most billing problems arise when providers assume that one identifier covers everything.

A common mistake happens after ownership changes. The practice updates its Tax ID but continues billing without updating enrollment. Claims still show the correct NPIs, but payment stops.

Another frequent issue appears when a provider joins a new group. Their NPI is valid, but it is not yet linked to the group’s Tax ID in payer systems. Claims are rejected even though services were rendered correctly.

From a billing standpoint, payers do not guess. If the identifiers do not match exactly, the claim does not move.

How NPIs and Tax IDs Work Together on Claims

Every clean claim links three things:

- The rendering provider NPI

- The billing provider or organization’s NPI

- The Tax ID associated with the payment

Payers validate these elements against enrollment records. If one piece does not match, the claim stops moving.

For example, a physician may render a service under their individual NPI. The claim bills are under the group NPI. Payment flows to the group’s Tax ID.

That structure is typical. It is also where many errors happen.

Common NPI vs Tax ID Errors Providers Make

Over the past year, several patterns have emerged across practices and specialties.

One frequent issue is billing under the correct NPI but linking it to the wrong Tax ID. This often happens when practices change ownership or restructure their business entity.

Another problem arises when providers enroll their NPI with one Tax ID but submit claims under another. Even if both belong to the same practice, payers treat this as a mismatch.

Locum tenens arrangements also create confusion. Providers may render services under their NPIs, but payments must be routed through the group’s Tax ID.

Each of these scenarios leads to claim delays or rejections.

Why Payers Are Enforcing Stricter Matching Rules

Payers are under pressure to reduce fraud, waste, and abuse. Automated validation helps them do that.

By cross-checking NPIs and Tax IDs against enrollment and IRS data, payers quickly spot inconsistencies. They no longer rely on manual review.

CMS has also increased coordination between Medicare Administrative Contractors and PECOS enrollment records. Claims that do not match enrollment data face immediate issues.

This trend will continue. Accuracy is becoming the baseline expectation.

Medicare’s Rules Around NPI and Tax ID Alignment

Medicare requires providers to enroll their NPIs in PECOS with the correct Tax ID. Claims must reflect that enrollment exactly.

If a provider changes their Tax ID due to a merger or restructuring, they must update PECOS before billing under the new structure.

Failing to do so often results in:

- Claims held for manual review

- Requests for revalidation

- Temporary payment suspensions

Medicare data shows that enrollment-related payment delays increased significantly during ownership changes, mainly due to NPI and TIN misalignment.

Commercial Payers and Their Added Complexity

Commercial payers add their own twists. Many require separate credentialing for each NPI–Tax ID combination.

A provider may be credentialed under one Tax ID but not another. Billing under the wrong combination leads to out-of-network processing or outright denial.

Some payers also enforce location-based matching. The NPI, Tax ID, and service location must all align with their records.

This makes internal tracking critical.

Pro Tips for Providers: Avoid NPI and Tax ID Billing Mistakes

After years of working inside real billing operations, one thing is clear. NPI and Tax ID issues rarely come from ignorance. They come from rushed processes, poor communication, and outdated enrollment records.

The good news is that most problems can be prevented.

- Start by treating identifiers as revenue-critical data, not clerical details. Every time a provider joins or leaves your practice, review how their NPI is linked to your Tax ID across all payers. Do not assume enrollment automatically updates. It does not.

- Next, centralize control. Maintain a single internal document listing all individual NPIs, organizational NPIs, associated Tax IDs, and enrolled payers. Update it whenever ownership, structure, or contracts change. This single step prevents countless billing errors.

- Always align enrollment before billing. If a Tax ID changes due to restructuring or acquisition, pause claims if needed. Submit enrollment updates first. Billing before enrollment almost always results in payment delays and rework.

- Train the billing and front-desk teams together. Scheduling staff often trigger billing issues by assigning visits under the wrong entity. When everyone understands how NPIs and Tax IDs connect, errors drop fast.

- Finally, audit proactively. Review denied and pending claims monthly for identifier-related trends. If you see repeated NPI–Tax ID issues, fix the root cause instead of appealing one claim at a time.

In healthcare billing, small identifier errors can lead to significant financial consequences. Discipline beats damage control every time.

Conclusion

The difference between NPI and Tax ID may sound administrative, but its impact is financial and operational. One identifies the provider who delivered care. The other identifies the entity that receives payment. When these roles are clear and aligned, billing flows smoothly.

In today’s environment, payers expect precision. Automated systems do not overlook mismatches. They stop claims instantly. That reality makes enrollment accuracy and identifier management more critical than ever.

Providers who understand this core difference avoid unnecessary denials, reduce payment delays, and maintain steady cash flow. Those who ignore it often spend months fixing preventable problems.

Clarity here is not just good practice; it’s essential. It is necessary for long-term stability.

Stop Losing Time and Revenue to Identifier Errors

NPI and Tax ID mismatches quietly stall payments and create compliance risks. Our billing experts review enrollment accuracy, correct NPI–Tax ID alignment, and prevent claim disruptions before they happen.

Let us handle the details while you focus on patient care.

Partner with ANR Medical Billing

FAQs

Can I bill claims if my NPI is correct, but my Tax ID recently changed?

You should avoid billing until enrollment updates are completed. Even with a valid NPI, most payers will delay or deny claims if the Tax ID does not match their records. Updating enrollment first prevents payment holds.

Does each provider in a group need their own NPI?

Yes. Individual providers use their own Type 1 NPIs to render services. The group practice uses a Type 2 NPI for billing. Both must be appropriately linked to the group’s Tax ID.

What happens if a provider is credentialed under one Tax ID but billed under another?

Claims may be processed as out-of-network or denied altogether. Credentialing is often specific to the NPI–Tax ID combination, especially with commercial payers.

Is a new NPI required when a practice changes ownership?

In most cases, no. NPIs usually stay the same. Ownership changes often require a new Tax ID and an updated enrollment, rather than a new NPI.

Why do Medicare claims delay after practice restructuring?

Medicare checks claims against PECOS enrollment. If NPIs are not linked to the new Tax ID in PECOS, claims may pend or suspend until revalidation is completed.

How often should providers review NPI and Tax ID enrollment?

At least once a year and whenever there is a change in ownership, location, or provider status, regular reviews help catch mismatches before they affect revenue.