GI cocktails are part of daily practice in many emergency departments and urgent care centers. Providers often give them to patients with upper abdominal pain, heartburn, or chest discomfort that appears non-cardiac. Clinically, this approach feels routine and low risk.

Billing for GI cocktails is different. Coding errors happen often. Many providers assume medications can be billed separately. Others believe administering a GI cocktail supports a higher visit level. These assumptions create denied claims, delayed payments, and audit exposure.

GI cocktail coding reimbursement depends on understanding evaluation and management coding, medication billing rules, bundling policies, and payer-specific guidelines. Small mistakes repeat across many visits. Over time, these mistakes cost money and increase compliance risk.

This provider guide explains GI cocktail coding reimbursement in clear terms. Each section breaks down the rules, documentation requirements, and real-world billing risks. The goal is simple. Help providers code accurately, stay compliant, and protect revenue.

What is a GI Cocktail in Clinical Practice?

A GI cocktail is a combination of medications used to treat gastrointestinal symptoms. Providers often give it during an evaluation rather than as a final treatment plan.

Clinical Purpose of a GI Cocktail

The primary goal is symptom relief. Patients may arrive with burning pain, pressure, nausea, or discomfort after eating. A GI cocktail can quickly reduce these symptoms.

Another purpose is assessment. When symptoms improve after treatment, providers may lean toward a gastrointestinal cause. However, symptom relief alone does not confirm a diagnosis. Providers must continue to carefully evaluate the patient.

Use as a Diagnostic Support Tool

Some clinicians use GI cocktails to help differentiate between gastrointestinal and cardiac-related pain. This approach requires caution. Relief after treatment does not rule out serious causes.

Documentation must reflect clinical judgment. Providers should clearly state that symptom improvement does not replace further evaluation when needed.

Common Conditions That Lead to GI Cocktail Use

Providers often give GI cocktails for:

- Epigastric pain

- Gastroesophageal reflux symptoms

- Dyspepsia

- Suspected gastritis

- Non-cardiac chest discomfort

Each condition carries different risk levels. Documentation should reflect that difference.

Typical Medication Components of a GI Cocktail

Medication composition affects billing rules and reimbursement.

Antacid Components

Antacids neutralize stomach acid. They often include aluminum hydroxide or magnesium hydroxide. These medications are usually oral and facility-supplied.

From a billing perspective, antacids are always bundled into the visit.

Viscous Lidocaine

Viscous lidocaine provides numbing relief to the stomach lining. Providers use it to reduce burning pain.

This medication is oral in most cases. Medicare and many payers bundle it into the evaluation and management service.

Antispasmodic or Anticholinergic Agents

Some facilities include antispasmodic medications. These reduce smooth muscle spasm.

If given orally, they follow bundling rules. If injected, payer policies may differ.

Why GI Cocktail Coding Reimbursement Matters for Providers

GI cocktail billing errors occur frequently because the treatment seems minor.

Cumulative Revenue Loss

One denied claim does not seem significant. Over hundreds of visits, it becomes a problem. Repeated under-coding also leads to lost revenue.

Correct coding protects financial stability.

Compliance and Audit Exposure

Emergency department billing receives close payer review. GI cocktail-related claims often appear in audits due to:

- High visit levels

- Repeated medication charges

- Inconsistent documentation

Compliance protects providers from penalties and recoupments.

Evaluation and Management Coding for GI Cocktail Visits

There is no CPT code for GI cocktail administration. The assessment and management service provides reimbursement.

E/M Coding in Emergency Settings

Emergency department visits use CPT codes 99281-99285. Providers select the code based on medical decision-making.

Medical decision making considers:

- Number of problems addressed

- Complexity of evaluation

- Data reviewed

- Risk of complications

Treatment alone does not determine our visit level.

Why Treatment Does Not Drive Visit Level

Administering a GI cocktail does not increase complexity. A simple case of indigestion may still warrant a low-level visit.

A chest pain evaluation with cardiac risk factors warrants a higher complexity level due to the risk and decision-making involved.

Documentation That Supports Correct E/M Coding

Providers should document:

- Detailed symptom onset and description

- Relevant medical history

- Differential diagnosis

- Diagnostic reasoning

- Treatment rationale

- Patient response

These elements support proper coding.

Medical Decision Making and GI Cocktail Use

Medical decision-making drives reimbursement.

Low Complexity Scenarios

A patient with mild indigestion and no risk factors may require minimal workup. GI cocktail use in this case supports symptom relief but not high complexity.

Moderate to High Complexity Scenarios

Chest pain, severe abdominal pain, or associated symptoms increase the risk. In these cases, the provider evaluates multiple conditions.

GI cocktail use does not create complexity. The evaluation does.

Medication Billing Rules for GI Cocktails

Medication billing causes confusion and frequent insurance claim denials.

Oral Medication Billing Rules

Most GI cocktails use oral medications. Medicare and many commercial payers bundle oral drugs given in the emergency department.

Key points include:

- Oral medications are not separately reimbursed

- Charges may appear on claims, but payment is bundled

- Separate billing leads to denials

Providers should understand this rule clearly.

Payers consider oral medications part of routine care. They do not view them as separately billable services in emergency settings.

Injectable Medication Billing Considerations

Some facilities use injectable components. In these cases, billing rules depend on payer policy.

Separate reimbursement may require:

- Payer approval

- Specific HCPCS codes

- Clear documentation

Never assume payment without verification.

Bundling Rules and National Correct Coding Initiative

Bundling rules control billing combinations.

What Bundling Means in Practice

Bundling means certain services are included in others. For GI cocktails, medication administration is usually included in the E/M service.

Attempting to bill separately violates bundling rules.

Role of NCCI Edits

NCCI automatically denies improper billing combinations. They protect payers from duplicate payments.

Providers should understand the everyday edits that affect emergency care.

Modifiers and GI Cocktail Billing

Modifiers rarely apply to GI cocktail billing. Incorrect modifier use raises audit risk.

Apply modifiers only when the payer policy clearly supports their use.

Medicare Guidelines for GI Cocktail Reimbursement

Medicare policies guide many payer decisions.

Medicare typically:

· Bundles oral medications

· Pays only for E/M services

· Requires strong documentation

Providers should review local Medicare Administrative Contractor guidance.

Official information is available at: https://www.cms.gov.

Medicare audits rely on documentation. Clear notes support medical necessity and coding decisions.

Medicaid Policies and State-Level Differences

Medicaid rules vary widely. Some state Medicaid programs closely follow Medicare. Others allow limited medication billing.

Providers must review state manuals regularly. Billing without understanding state rules increases the risk of denials. Regular updates protect compliance.

Commercial Payer Rules for GI Cocktail Billing

Commercial insurers differ significantly. Commercial payer reimbursement depends on contract terms. Some contracts allow separate medication billing.

Others fully bundle services.

Providers should verify coverage before billing medications. Assumptions lead to denials.

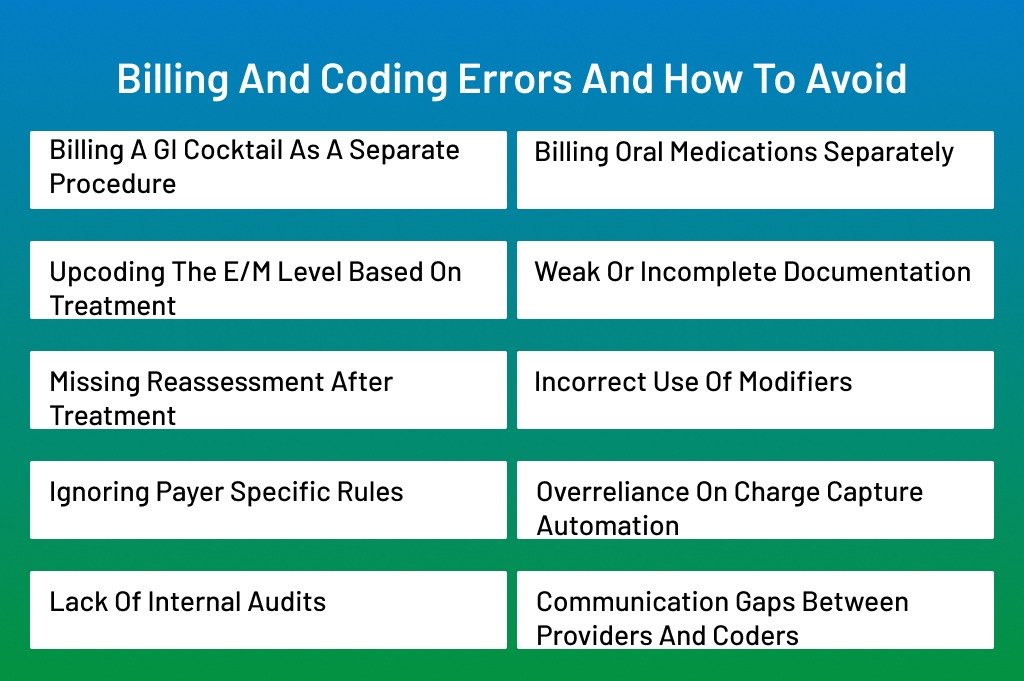

Billing and Coding Errors and How to Avoid

Billing and coding errors related to GI cocktails happen often. The reason is simple. The treatment feels routine, but the billing rules are strict. When providers rely on assumptions instead of payer rules, mistakes occur.

These errors affect revenue, compliance, and audit risk. Understanding the most common problems helps providers avoid them. Prevention always costs less than correction.

This section explains the most common billing and coding errors associated with GI cocktails and provides clear ways to avoid them.

Billing a GI Cocktail as a Separate Procedure

One of the most common mistakes is billing a GI cocktail as a standalone service.

Providers often assume that mixing or administering medications qualifies as a billable procedure. This belief stems from how GI cocktails are usually used.

However, no CPT code exists for GI cocktail administration.

Payers view GI cocktails as part of routine care. They consider the treatment included in the evaluation and management service.

When billed separately, claims are automatically denied.

Providers should remember:

- There is no CPT code for GI cocktails

- Administration is bundled into the E/M service

- Medication preparation does not create a billable procedure

Training and coder review help prevent this mistake.

Billing Oral Medications Separately

Another frequent error involves medication charges.

Some facilities add medication charges automatically. Others believe all administered drugs qualify for payment.

This assumption leads to billing oral antacids or lidocaine separately.

Most payers, including Medicare, bundle oral medications given in emergency settings. They view them as part of routine care.

As a result:

- Claims deny medication charges

- Repeated errors trigger audits

Providers and billing teams should:

- Confirm whether medications are oral or injectable

- Review payer policies regularly

- Educate staff on bundled services

Clear rules prevent repeated denials.

Upcoding the E/M Level Based on Treatment

Some providers increase the visit level because a GI cocktail was given.

Treatment feels like added work. Providers may believe medication use reflects higher complexity.

However, coding rules do not work this way.

E/M levels depend on medical decision-making. Treatment alone does not determine complexity.

Upcoding increases audit risk and repayment demands.

Providers should focus on:

- Number of problems addressed

- Risk to the patient

- Diagnostic reasoning

Documentation should support decision-making, not just treatment.

Weak or Incomplete Documentation

Poor documentation is a root cause of many billing problems.

Common reasons include:

- Time pressure

- Copy-paste habits

- Overreliance on templates

These issues lead to vague notes.

Payers rely on documentation to assess medical necessity. Weak notes fail to support coding decisions.

This leads to:

- Downcoding

- Denials

- Audit exposure

Providers should document:

- Clear symptoms and onset

- Differential diagnosis

- Reason for GI cocktail use

- Patient response after treatment

Strong notes protect claims.

Missing Reassessment After Treatment

Reassessment is often overlooked.

A GI cocktail is part of an active evaluation. Payers expect follow-up documentation showing the response.

Without reassessment, treatment appears incomplete.

Missing reassessment weakens medical necessity. It suggests minimal evaluation.

This can lead to:

- Lower visit levels

- Denials during audits

Providers should add a brief reassessment note that includes:

- Symptom improvement or persistence

- Next steps in care

- Disposition decision

Even short reassessment notes add strong support.

Incorrect Use of Modifiers

Modifiers confuse GI cocktail billing.

Some billing teams try modifiers to bypass bundling edits. This approach backfires.

Improper modifiers use potential abuse signals. Payers review these claims closely.

Providers should:

- Use modifiers only when clearly allowed

- Follow payer-specific guidance

- Avoid modifier use for routine GI cocktail care

When in doubt, do not use a modifier.

Ignoring Payer Specific Rules

Not all payers follow the same policies.

Providers often apply Medicare rules to all payers. This leads to mistakes with Medicaid and commercial plans.

Each payer has its own coverage rules. Ignoring them results in denials and delays.

Billing teams should:

- Review payer manuals regularly

- Keep payer grids updated

- Educate staff on differences

Knowledge prevents wasted effort.

Overreliance on Charge Capture Automation

Automation helps but does not replace review.

Automated systems may automatically add medication charges. They do not interpret payer rules.

Without review, incorrect charges reach claims. Denials follow.

Best practices include:

- Regular system audits

- Manual review of high-risk charges

- Provider education

Technology works best with oversight.

Lack of Internal Audits

Many errors repeat because no one looks for them.

Audits identify patterns early. They allow correction before the payer’s act.

Without audits, errors continue unnoticed. Payers find them.

Providers should:

- Audit a sample of GI cocktail visits

- Review documentation and codes

- Provide feedback to staff

Small audits prevent big problems.

Communication Gaps Between Providers and Coders

Communication gaps cause misinterpretation.

Providers and coders work under different pressures. They may not share expectations.

Coders rely on provider notes. If notes lack clarity, coders must guess.

Guessing leads to errors.

Strong communication helps. This includes:

- Shared education sessions

- Coding feedback loops

- Clear documentation standards

Teamwork improves accuracy.

Conclusion

GI cocktail coding reimbursement may look simple at first. In practice, it requires careful attention. Providers must understand that there is no separate billing code for a GI cocktail. Payment depends on correct evaluation and management coding and strong documentation.

Most errors come from assumptions. Oral medications are usually bundled. Treatment does not find the visit level. Documentation drives everything. When providers miss these points, denials and audits follow.

Accurate coding protects revenue and compliance. Clear notes support medical necessity. Regular education keeps teams aligned. Internal audits catch mistakes early. When providers follow these steps, billing becomes predictable and defensible.

GI cocktails will remain common in emergencies and urgent care settings. Providers who understand the rules will stay ahead of denials and reduce audit risk. Correct coding is not optional. It is essential for long-term success.

Struggling with denied claims, underpayments, or audit pressure related to GI cocktail billing?

ANR Medical Billing in Connecticut helps providers get it right the first time. Our team reviews documentation, coding patterns, and payer rules to identify errors before payers do. We focus on compliance, accuracy, and revenue protection.

With ANR Billing, providers gain:

· Expert review of E/M coding and documentation

· Identification of bundled service errors

· Payer-specific billing guidance

· Ongoing audit support and education

Stop guessing. Start billing with confidence—partner with ANR Billing to protect your revenue and reduce compliance risk.

Frequently Asked Questions

Can a GI cocktail ever be billed as a separate service?

There is no CPT code for GI cocktail administration. Payers consider it part of routine care. Providers bill only for the evaluation and management service. Attempting to bill it separately leads to denials.

Why do payers bundle oral GI cocktail medications?

Payers view oral medications given in emergency settings as part of standard treatment. They do not consider them separate billable services. Because of this, oral antacids and lidocaine are bundled into the E/M visit.

Does giving a GI cocktail support a higher E/M level?

No. E/M levels depend on medical decision-making, not on treatment. Providers must document the complexity of the evaluation, the risks considered, and the diagnostic reasoning. Treatment alone does not increase the visit level.

What documentation best supports GI cocktail-related visits?

Strong documentation includes clear symptoms, differential diagnosis, treatment rationale, and post-treatment patient response. Reassessment notes are essential. These details support medical necessity and coding accuracy.

How can providers reduce audit risk related to GI cocktail billing?

Providers reduce audit risk by understanding payer rules, documenting clearly, avoiding separate medication billing, and performing regular internal audits. Ongoing education and coder communication also play a key role.