Many patients, employers, and healthcare providers confuse Optum and UnitedHealthcare because both operate under the same corporate umbrella. However, their roles in the modern healthcare ecosystem are fundamentally different. One focuses on insurance coverage. The other focuses on care delivery, pharmacy, and health technology.

Understanding this difference matters. It affects how claims get paid. It shapes how care is delivered. It also explains why your insurance card may say UnitedHealthcare while your pharmacy or clinic mentions Optum.

This guide explains everything step by step. It compares services, roles, costs, networks, and real-world use cases. By the end, the difference will be crystal clear.

Quick Answer: What Is the Difference Between Optum and UnitedHealthcare?

UnitedHealthcare functions as the payer in the healthcare system, designing benefit structures and reimbursing providers for covered services.

Optum functions as the services and operations arm, delivering care, managing pharmacy benefits through OptumRx, and providing analytics infrastructure.

Relationship Between Optum and UnitedHealthcare

Before comparing features, it helps to understand how these companies connect. They are not competitors in the traditional sense. Instead, they work side by side under one corporate structure.

UnitedHealthcare and Optum both operate under UnitedHealth Group. UnitedHealth Group acts as the parent organization. Each subsidiary has its own mission and focus.

UnitedHealthcare handles insurance. Optum handles services that support care and payment systems.

This structure allows UnitedHealth Group to manage health care from multiple angles. Insurance coverage, care delivery, data, and pharmacy all sit under one roof. That integration is intentional.

Key points to understand this relationship:

· UnitedHealthcare focuses on paying for care

· Optum focuses on delivering and managing care

· Both operate independently but share infrastructure

· The parent company coordinates long-term strategy

Market Position and Industry Influence

UnitedHealth Group is one of the largest healthcare organizations in the United States. Through its two major arms — UnitedHealthcare and Optum — it operates across insurance, care delivery, pharmacy benefit management, and health technology.

UnitedHealthcare is one of the largest managed care organizations in the country, serving millions of members through employer plans, Medicare Advantage, and Medicaid managed care programs regulated by the Centers for Medicare & Medicaid Services. As a managed care organization (MCO), UnitedHealthcare assumes financial risk for member populations while coordinating provider reimbursement and network contracts.

Optum plays a major role in healthcare vertical integration by combining:

- Population health management

- Pharmacy benefit management (PBM)

- Risk adjustment analytics

- Value-based care infrastructure

This structure represents a broader shift toward payer-provider integration in the modern healthcare ecosystem.

What UnitedHealthcare Does in the Health Care System

UnitedHealthcare operates as a health insurance carrier. Its primary role is financial. It collects premiums. It defines benefits. It pays providers for covered services.

When a patient visits a doctor, UnitedHealthcare determines whether the service is covered. It also decides how much the provider gets paid and how much the patient owes.

UnitedHealthcare serves millions of members across the US. It offers plans for individuals, employers, and government programs.

Its insurance offerings are built around risk management, coverage design, and network contracting.

UnitedHealthcare’s core responsibilities include:

· Designing health insurance plans

· Managing member eligibility and enrollment

· Contracting with doctors and hospitals

· Processing and paying medical claims

· Managing prior authorizations and coverage rules

UnitedHealthcare does not deliver care directly in most cases. Instead, it pays for care delivered by contracted providers.

What Optum Does in the Health Care System

Optum operates as a health services and care solutions company. Its role is operational, clinical, and analytical rather than insurance-based.

Optum focuses on improving how care is delivered, managed, and measured. It supports patients, providers, employers, and insurers.

In many cases, Optum works behind the scenes. Patients may interact with Optum without realizing it.

Optum is divided into three central business units, each serving a different function in health care.

Optum’s primary responsibilities include:

· Delivering care through clinics and physician groups

· Managing pharmacy benefits and prescription access

· Providing health data, analytics, and technology platforms

· Supporting care coordination and population health

· Improving outcomes while controlling costs

Optum does not usually decide coverage rules. Instead, it helps execute and optimize care once coverage is in place.

Comparing Core Services Side by Side

While both companies operate in health care, their services rarely overlap. They complement each other instead.

UnitedHealthcare focuses on coverage and payment. Optum focuses on care delivery and support systems.

UnitedHealthcare Core Services

UnitedHealthcare builds insurance products that define how members access care. These products vary by plan type, geography, and payer program.

Each plan outlines what services are covered, which providers are in network, and how costs are shared.

UnitedHealthcare’s services revolve around benefit administration and financial risk.

Main service areas include:

· Employer-sponsored health plans

· Individual and family health plans

· Medicare Advantage and Medicare Supplement

· Medicaid managed care plans

· Prescription drug coverage through insurance plans

Every decision made by UnitedHealthcare affects premiums, deductibles, and reimbursement rates.

Optum Core Services

Optum’s services focus on execution rather than coverage rules. It helps ensure care is delivered efficiently and effectively.

Its three divisions each play a specific role.

OptumHealth focuses on care delivery and patient support:

· Primary care and specialty clinics

· Urgent care centers

· Care coordination programs

· Chronic condition management

OptumRx focuses on pharmacy benefit management:

· Prescription drug pricing

· Mail-order and specialty pharmacies

· Formulary management

· Medication adherence programs

OptumInsight focuses on data and technology:

· Revenue cycle analytics

· Clinical decision support

· Risk adjustment tools

· Compliance and performance insights

Together, these services improve the flow of care through the system.

Insurance Coverage and Plan Design Differences

Coverage is where the most considerable distinction appears. Only one of these companies sells insurance directly.

UnitedHealthcare and Insurance Coverage

UnitedHealthcare designs insurance plans with specific rules. These rules govern access, payment, and cost sharing.

Plans differ based on the target population and funding source.

Each plan includes detailed benefit documents. These documents define coverage limits, exclusions, and patient responsibility.

Coverage elements controlled by UnitedHealthcare include:

· Premium amounts

· Deductibles and copayments

· Coinsurance percentages

· Prior authorization requirements

· Network restrictions

UnitedHealthcare decides whether a service is medically necessary under plan rules.

Optum’s Role in Coverage Decisions

Optum does not design insurance benefits. It does not set premiums or deductibles.

However, Optum influences care after coverage is approved. It helps ensure care is appropriate, timely, and cost-effective.

Optum’s indirect role in coverage includes:

· Supporting care management programs

· Providing clinical guidelines

· Managing pharmacy formularies through OptumRx

· Offering insights that influence policy design

Optum supports the system without acting as the payer.

Provider Networks and Access to Care

Network size affects patient choice and provider participation.

UnitedHealthcare Provider Networks

UnitedHealthcare maintains one of the largest provider networks in the country. It contracts with physicians, hospitals, and facilities across many regions.

Network access depends on the plan type. PPO plans offer broader access. HMO plans limit care to designated networks.

UnitedHealthcare negotiates rates and contract terms with providers.

Network characteristics include:

· National coverage in many plans

· Strong hospital participation

· Wide specialist access

· Tiered networks in some markets

These networks determine where members can seek care at a lower cost.

Optum’s Provider Presence

Optum does not operate traditional insurance networks. Instead, it owns and partners with provider groups.

Optum clinics may accept multiple insurance plans, including non-UnitedHealthcare coverage.

Its focus is on care delivery quality rather than network design.

Optum’s provider role includes:

· Operating physician practices

· Supporting value-based care models

· Coordinating care across settings

· Improving clinical workflows

Optum providers may be in or out of UnitedHealthcare networks, depending on their contracts.

Cost Structure and Financial Impact

Costs matter to patients, employers, and providers.

UnitedHealthcare Cost Model

UnitedHealthcare’s costs are member-facing. Members pay premiums and out-of-pocket expenses.

Plan pricing depends on risk pools, benefits, and market competition.

UnitedHealthcare manages financial risk by balancing premiums against claims.

Cost factors include:

· Monthly premiums

· Annual deductibles

· Copays and coinsurance

· Out-of-pocket maximums

Members experience costs directly at the point of care.

Optum’s Cost Influence

Optum does not charge premiums. Its financial impact appears indirectly.

Optum reduces costs by improving efficiency and outcomes.

Savings may flow to insurers, employers, or patients over time.

Optum reduces costs through:

· Better medication management

· Reduced hospital admissions

· Improved chronic care outcomes

· Data-driven decision making

These savings support long-term sustainability.

Customer Experience and Support

Both companies interact with users differently.

UnitedHealthcare Member Experience

UnitedHealthcare interacts with members mainly through administrative functions.

Members use portals to manage benefits and claims.

Support focuses on insurance-related issues.

Member touchpoints include:

· Claims status tracking

· Coverage verification

· Provider search tools

· Customer service lines

The experience centers on benefit management. Members primarily interact with UnitedHealthcare as their insurance administrator, not as a direct care provider.

Optum User Experience

Optum interacts through care services and pharmacy support.

Patients may engage with clinicians, pharmacists, or care coordinators.

Support feels more clinical than administrative.

User touchpoints include:

· Pharmacy assistance

· Care coordination teams

· Virtual care services

· Wellness and coaching programs

The experience focuses on care delivery.

Technology and Data Capabilities

Technology plays a major role in modern health care.

UnitedHealthcare Technology Use

UnitedHealthcare uses technology to support members and providers.

Its tools focus on transparency and administration.

Technology applications include:

· Digital ID cards

· Cost comparison tools

· Telehealth access

· Claims processing systems

Technology improves convenience and access.

Optum’s Technology Leadership

Optum is a leader in health data analytics.

Its systems analyze massive data sets to identify trends and risks.

These insights improve quality and reduce waste.

Technology strengths include:

· Predictive analytics

· Risk adjustment modeling

· Revenue cycle intelligence

· Clinical decision support

These tools are frequently used in population health management programs and integrated delivery networks.

What This Means for Providers and Billing Teams

Understanding the difference between UnitedHealthcare and Optum directly impacts revenue cycle operations.

Claims Adjudication and Reimbursement Control

UnitedHealthcare controls the claims adjudication process. This means it reviews submitted claims, applies medical necessity rules, evaluates contract terms, checks policy language, and determines final reimbursement amounts.

The insurer evaluates:

• Coverage eligibility

• Coding accuracy

• Prior authorization compliance

• Contracted reimbursement schedules

• Deductible and coinsurance application

Optum does not directly pay or deny medical claims. However, through OptumInsight and related analytics platforms, it may influence documentation standards, risk scoring, and performance metrics used in value-based arrangements.

For billing teams, understanding where adjudication authority resides helps prevent routing errors and reimbursement delays.

Prior Authorization and Utilization Review

In some employer-sponsored arrangements, UnitedHealthcare may operate as an Administrative Services Organization (ASO), meaning it administers claims and utilization management on behalf of a self-funded employer. In these structures, coverage decisions still follow employer plan documents, while operational workflows may involve coordination across UnitedHealthcare and Optum systems.

This layered structure can affect authorization timelines, appeals processes, and reimbursement workflows.

Pharmacy vs Medical Claims

Medical claims are typically processed through UnitedHealthcare.

Pharmacy claims are often processed through OptumRx, operating as the pharmacy benefit manager (PBM).

For medical billing service providers, this separation matters. Incorrect routing or misunderstanding benefit structures can delay payment.

Risk Adjustment and HCC Impact

Optum’s analytics platforms often support risk-bearing entities and value-based care programs. Proper documentation and coding directly influence reimbursement outcomes in these models.

For providers, understanding this structure reduces denials, accelerates reimbursements, and improves clean claim rates.

In value-based care arrangements, provider groups may operate as risk-bearing entities, meaning reimbursement depends on quality metrics and population health performance. Optum’s analytics platforms often support these models by analyzing outcomes, identifying care gaps, and assisting with Hierarchical Condition Category (HCC) documentation accuracy.

This is especially important in Medicare Advantage programs administered by UnitedHealthcare.

Strengths and Limitations Compared

Every organization has trade-offs.

UnitedHealthcare Strengths and Limits

UnitedHealthcare excels at scale and coverage.

However, complexity can frustrate members.

Strengths:

· Broad insurance offerings

· Large provider networks

· Strong market presence

Limitations:

· Complex plan rules

· Variable customer service

· Cost differences across markets

Optum Strengths and Limits

Optum excels at integration and innovation.

However, its role is less visible to consumers.

Strengths:

· Advanced analytics

· Integrated care delivery

· Strong pharmacy management

Limitations:

· Limited direct consumer insurance role

· Confusion about responsibilities

· Dependent on payer contracts

How Optum and UnitedHealthcare Compare to Other Major Insurers

In the broader managed care market, UnitedHealthcare competes with national carriers such as:

- Aetna

- Cigna

- Blue Cross Blue Shield

What makes UnitedHealthcare unique is its integration with Optum. Few competitors operate such a vertically integrated structure combining payer, provider services, analytics, and pharmacy benefit management under one corporate umbrella.

This integration influences reimbursement strategy, network design, and cost control initiatives.

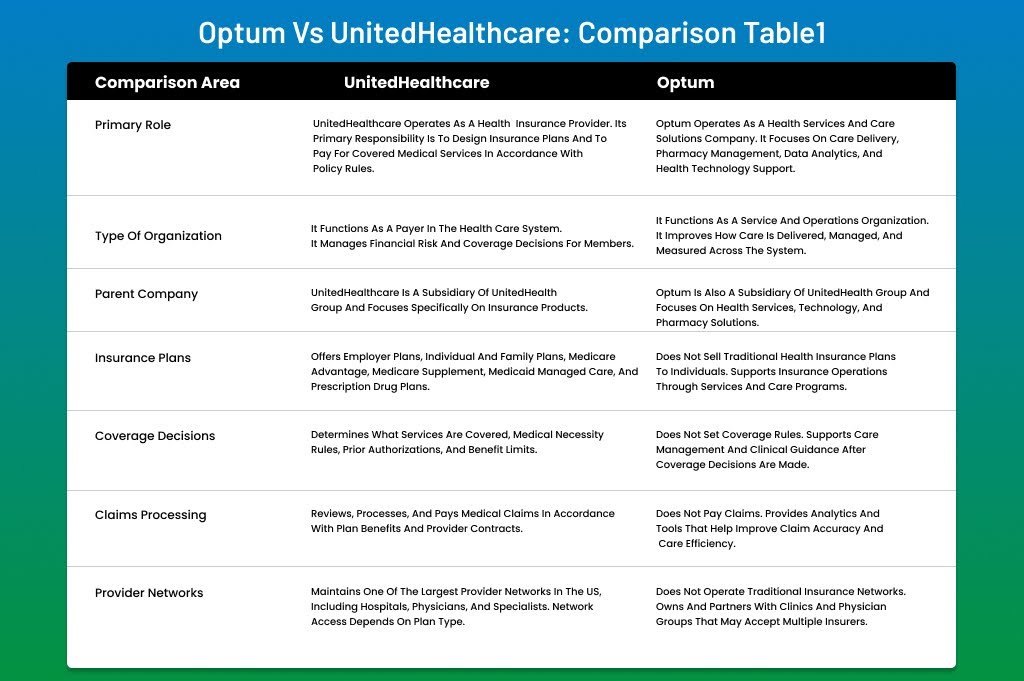

Optum vs UnitedHealthcare: Comparison Table

| Comparison Area | UnitedHealthcare | Optum |

| Primary Role | UnitedHealthcare operates as a health insurance provider. Its primary responsibility is to design insurance plans and to pay for covered medical services in accordance with policy rules. | Optum operates as a health services and care solutions company. It focuses on care delivery, pharmacy management, data analytics, and health technology support. |

| Type of Organization | It functions as a payer in the health care system. It manages financial risk and coverage decisions for members. | It functions as a service and operations organization. It improves how care is delivered, managed, and measured across the system. |

| Parent Company | UnitedHealthcare is a subsidiary of UnitedHealth Group and focuses specifically on insurance products. | Optum is also a subsidiary of UnitedHealth Group and focuses on health services, technology, and pharmacy solutions. |

| Insurance Plans | Offers employer plans, individual and family plans, Medicare Advantage, Medicare Supplement, Medicaid managed care, and prescription drug plans. | Does not sell traditional health insurance plans to individuals. Supports insurance operations through services and care programs. |

| Coverage Decisions | Determines what services are covered, medical necessity rules, prior authorizations, and benefit limits. | Does not set coverage rules. Supports care management and clinical guidance after coverage decisions are made. |

| Claims Processing | Reviews, processes, and pays medical claims in accordance with plan benefits and provider contracts. | Does not pay claims. Provides analytics and tools that help improve claim accuracy and care efficiency. |

| Provider Networks | Maintains one of the largest provider networks in the US, including hospitals, physicians, and specialists. Network access depends on plan type. | Does not operate traditional insurance networks. Owns and partners with clinics and physician groups that may accept multiple insurers. |

| Care Delivery | Does not directly deliver care in most cases. Pays providers for services offered to members. | Directly delivers care through Optum-owned clinics, urgent care centers, and physician practices. |

| Pharmacy Services | Includes prescription drug coverage as part of insurance plans, often managed through a partner. | Manages pharmacy benefits through OptumRx, including mail-order, specialty pharmacy, and formulary management. |

| Technology Use | Uses technology for member portals, claims management, cost tools, telehealth access, and benefit administration. | Uses advanced analytics, clinical data platforms, predictive modeling, and revenue cycle intelligence tools. |

| Customer Interaction | Interacts primarily with members regarding insurance-related needs, such as claims, eligibility, and coverage questions. | Interacts with patients, providers, and employers to coordinate care, provide pharmacy support, and support clinical programs. |

| Cost Structure | Members pay premiums, deductibles, copays, and coinsurance, depending on the plan design. | Does not charge premiums. Helps reduce overall health care costs through efficiency and care optimization. |

| Value Focus | Focuses on managing risk, controlling claims costs, and offering competitive insurance products. | Focuses on improving outcomes, reducing waste, and enhancing care quality through data-driven solutions. |

| Who Should Use It | Individuals, families, employers, and seniors who need health insurance coverage. | Providers, employers, insurers, and patients who need care services, pharmacy management, or health technology support. |

Which One Should You Choose?

Choosing between Optum and UnitedHealthcare is not about picking one over the other in every situation. The right choice depends on your role in the health care system and what problem you are trying to solve. Many people assume they must choose one company. In reality, most people already use both in different ways.

If your primary need is health insurance, UnitedHealthcare is the right choice. UnitedHealthcare designs insurance plans that cover doctor visits, hospital care, prescriptions, and preventive services. It determines premiums, deductibles, copays, and coverage limits. Individuals, families, employers, and Medicare beneficiaries rely on UnitedHealthcare to pay claims and manage benefits. When your concern is affordability, network access, or plan options, the insurance carrier matters most, and UnitedHealthcare fits the bill.

Key situations where UnitedHealthcare is the right choice include:

· You need an employer-sponsored or individual health insurance plan

· You are enrolling in Medicare Advantage or Medicaid managed care

· You want access to a broad provider network

· You need clear benefit rules and claim payment support

If your need extends beyond coverage to care delivery or health management, Optum becomes essential. Optum focuses on services that support actual care. This includes pharmacy benefit management through OptumRx, care coordination programs, and clinics that deliver primary or specialty care. Providers and employers often rely on Optum for analytics, population health tools, and care optimization. Patients may interact with Optum through pharmacies, virtual care, or care management programs.

Situations where Optum plays a key role include:

· You need prescription management or specialty pharmacy services

· You receive care through an Optum clinic or physician group

· You participate in a care coordination or wellness program

· Your organization needs health data, analytics, or operational support

For most people, this is not an either-or decision. Insurance and care services work together. A patient may have a UnitedHealthcare insurance plan and fill prescriptions through OptumRx while visiting an Optum-affiliated clinic. This happens quietly in the background, which is why many people do not realize they are using both companies at the same time.

In simple terms, UnitedHealthcare pays for care, while Optum helps deliver and manage that care. Understanding this distinction enables you to make better decisions, avoid confusion, and know where to turn when questions arise.

Conclusion

Optum and UnitedHealthcare often appear interchangeable, but their roles in health care are very different. UnitedHealthcare operates as an insurance carrier. It focuses on coverage, plan design, and claim payments. Optum works on the service side. It supports care delivery, pharmacy management, data analysis, and health technology. Both function under the same parent company, yet each serves a unique purpose.

Understanding this distinction helps patients, providers, and employers avoid confusion. If the goal is to secure insurance coverage and manage medical costs, UnitedHealthcare is the primary point of contact. If the goal is to improve care quality, manage prescriptions, or use data-driven health tools, Optum plays a central role. In most cases, people interact with both without realizing it. Together, they create a more connected healthcare experience where coverage and care work in sync rather than in silos.

Ready to Turn Confusion Into Clean Claims?

When payer structures become vertically integrated, billing becomes more complex. Coverage rules may sit with UnitedHealthcare, while pharmacy benefits or analytics tools operate through Optum.

Misunderstanding these relationships can result in:

- Incorrect claim routing

- Pharmacy billing denials

- Prior authorization delays

- Risk adjustment underpayments

At ANR Medical Billing, we understand how UnitedHealthcare and Optum work together. Our team works with commercial plans, Medicare Advantage contracts, pharmacy benefit workflows, and integrated payer-provider systems. We understand how vertically integrated models affect eligibility verification, prior authorization routing, risk adjustment documentation, and claims adjudication accuracy.

That expertise translates into fewer denials, faster payments, and stronger revenue cycle performance.

We optimize:

- Eligibility verification

- Accurate CPT and ICD-10 coding

- Clean claim submission

- Prior authorization workflows

- Timely A/R follow-up

Request a free billing assessment today and eliminate payer confusion before it impacts your revenue.

Frequently Asked Questions

Why do I see both Optum and UnitedHealthcare on my medical or pharmacy paperwork?

This usually happens because UnitedHealthcare provides the insurance coverage, while Optum manages specific services such as pharmacy benefits, care coordination, or clinic operations. Each company handles a different part of your health care journey.

Can I use Optum services if my insurance is not with UnitedHealthcare?

Some Optum services, such as clinics or pharmacy programs, may accept multiple insurance plans. Access depends on contracts, location, and the specific Optum service being used. It is always best to verify eligibility before receiving care.

Does Optum have any role in claim approvals or denials?

Optum may provide clinical insights or care management support, but final claim approvals and payment decisions usually remain with the insurance carrier. UnitedHealthcare typically controls coverage rules and reimbursement decisions.

Is Optum Part of Medicare?

Optum is not Medicare itself. Medicare is a federal health insurance program administered by the Centers for Medicare & Medicaid Services (CMS). However, Optum may provide analytics, care coordination, or pharmacy benefit management services that support Medicare Advantage plans offered by insurers such as UnitedHealthcare. In those cases, Medicare coverage rules are set by CMS, while operational services may involve Optum systems.

Is OptumRx the same as UnitedHealthcare pharmacy coverage?

OptumRx manages pharmacy benefits, while UnitedHealthcare offers prescription coverage as part of insurance plans. OptumRx often administers the drug benefit on behalf of UnitedHealthcare, handling formularies, pricing, and pharmacy access.

Why does UnitedHealthcare use Optum instead of managing everything itself?

Using Optum allows UnitedHealthcare to focus on insurance while relying on specialized services for care delivery, pharmacy management, and data analytics. This division of roles improves efficiency and helps control costs across the system.

Do providers work directly with Optum or UnitedHealthcare?

Providers often work with both. They contract with UnitedHealthcare for insurance reimbursement and may also work with Optum for care delivery programs, analytics tools, or clinic partnerships.

How does this relationship affect patients in real life?

For patients, the relationship often improves coordination. Insurance coverage comes from UnitedHealthcare, while care support, pharmacy services, or data-driven programs may come from Optum. When aligned properly, this setup can lead to smoother care experiences and better outcomes.